Column: Why the short-term health plans Trump favors are cheap: They shortchange you on care - Los Angeles Times

President Trump and other foes of the Affordable Care Act have made the expansion of short-term health plans a centerpiece of their campaign to gut the ACA.

Their argument is that the plans, which the ACA limits to three-month nonrenewable terms, can bring cheaper coverage to millions of Americans supposedly burdened by the law’s mandate that every health plan offer certain minimum benefits.

Two new statistical releases, however, reveal exactly why these plans are less expensive and less useful to the Americans Trump claims to be helping.

These policies are not right for everyone.

Golden Rule Insurance Co.

They come from the government’s own Center for Medicare and Medicaid Services (CMS), and from the National Assn. of Insurance Commissioners.

Both releases tell the same story: Short-term plans are cheaper because the insurers that issue them spend only pennies on actual healthcare for policyholders.

Advertisement

So little, in fact, that Trump’s 2017 executive order promoting the plans and a regulation proposed in 2018 to put his order into action can be seen not as a boon to insurance customers, but as a Bill of Rights for the insurance industry. The short-term issuers tend to reject customers with preexisting conditions, don’t cover pregnancy, and limit other services in dozens of ways not permitted for plans subject to the Affordable Care Act.

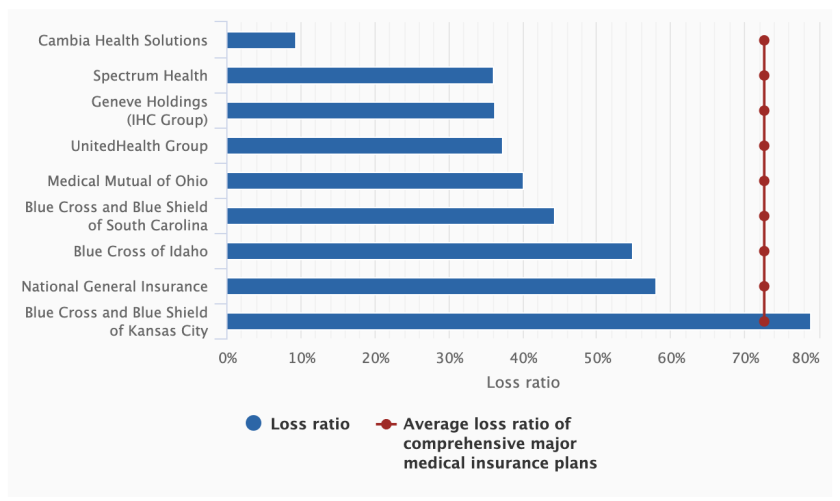

At least one short-term insurance issuer spent less than 10 cents of every premium dollar collected on healthcare, according to the NAIC figures, which were assiduously crunched by Shelby Livingston of Modern Healthcare. The top three short-term issuers — the giant UnitedHealth Group, National General and the private equity-owned Geneve Holdings — spent a combined 43.8% of their premiums on delivering health services to customers. They account for 80% of the short-term market.

For perspective, the Affordable Care Act requires that qualified plans spend at least 80% of premium dollars on healthcare services. (For large group policies, the standard is 85%.) This figure is known as the medical loss ratio, or MLR. The best way for an insurance company to turbocharge its profits, obviously, is to push its MLR down. That’s why a key provision of the ACA forbids insurers to spend less than 80%.

Advertisement

Short-term plans, however, are not subject to MLR rules, because the law doesn’t regard them as legitimate insurance. The Obama administration limited the short-term plans to 90 days; Trump wants to allow them to remain in place for a year and to be renewed after that.

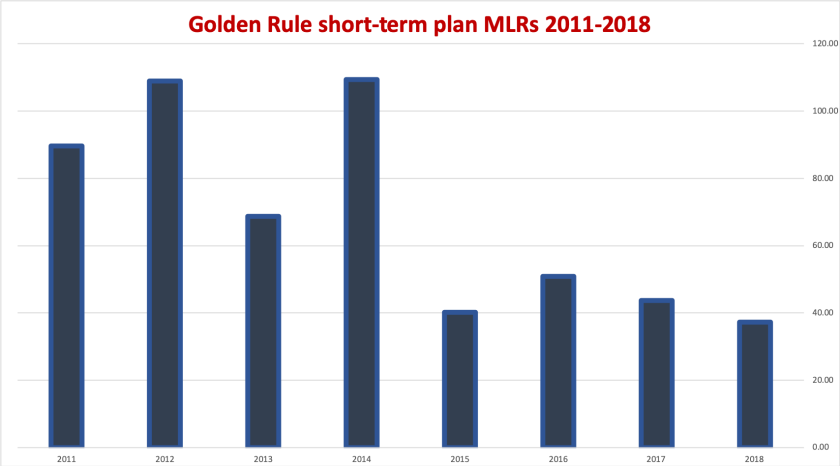

The medical loss ratios of Golden Rule's short-term plans have been coming down since 2011, meaning higher profits for the company.

(NAIC)

Insurance experts are concerned, rightly, that combined with the Republicans’ cancellation of the financial penalty imposed by the ACA for not carrying health insurance, the expansion of short-term plans will siphon healthier and younger customers out of the ACA insurance pool, making good insurance more costly for everyone else.

Let’s take a look at how short-term plans get away with lowballing their insurance customers. Our example is Golden Rule Insurance, which is owned by UnitedHealth. Its short-term plans are available in about a dozen states — others, including California, have outlawed these plans.

According to Golden Rule’s standard brochure, an earlier version of which we reviewed last year, the plan doesn’t cover preexisting conditions, which it defines as any condition for which medical advice or care was sought in the 24 months prior to the plan’s effective date, or would have caused “an ordinarily prudent person” to seek such advice or care in the 12 months prior to the effective date.

Medical loss ratios of almost all short-term insurance companies undercut the required medical spending of genuine insurance plans--mostly because their benefits are skimpy for the price. UnitedHealth Group's plans are marketed under the Golden Rule label.

(NAIC, via Modern Healthcare)

As we observed previously, this definition would allow the insurer to delve deeply into a customer’s health retroactively for two years should he or she present UnitedHealth with a claim. This was a habit health insurers engaged in freely before the ACA banned the practice.

Advertisement

The plan’s prescription benefit is a skimpy $3,000, and it’s provided only through a discount card worth 20% to 25% of the cost of a prescription, leaving the customer exposed to what could be thousands of dollars in prescription expenses. It caps lifetime benefits for all services as low as $250,000.

The plan doesn’t cover pregnancy, most abortions, most organ transplants or chemotherapy associated with bone marrow transplants. It won’t cover injuries incurred on a motorcycle or while horseback riding or skiing.

It won’t cover hospital nursing services or room and board if the customer is admitted on a Friday or Saturday, unless it’s an emergency or to prep for surgery scheduled for the next day. In central Florida, to pick a market at random, Golden Rule charges $55-70 per month for these plans and imposes a $12,500 deductible.

According to the NAIC and CMS data, Golden Rule paid out less than 40 cents of every short-term premium dollar on medical claims in 2018. (The CMS figure includes short-term, Medigap, dental, vision, accident and a few other lines in an “other health business” disclosure; Golden Rule declined to break out short-term plans alone. The NAIC data are for “short-term medical” plans.)

“Short-term, limited duration insurance helps increase choice and coverage by providing a broad portfolio of low-cost options that meet the unique needs of individuals,” a Golden Rule spokesman told me. “In some cases, these policies better meet the needs of some consumers compared to Exchange [ACA] products.”

That’s true, up to a point. Some people need a short-term plan as a bridge between employer health insurance plans when changing jobs, transitioning to Medicare, or experience some other gap in coverage expected to last only a few weeks or months. But these plans are dangerously unsuited to be used as substitutes for ACA-regulated insurance for any substantial period. Over the course of a few months anything can befall anyone — a traffic accident, a cancer diagnosis, a skiing mishap. At that point, those who tried to save money by purchasing a health plan that left such eventualities uncovered would discover they had made a very costly miscalculation.

Advertisement

Golden Rule says the MLRs of its limited-duration plans “can vary significantly from year to year due to the shorter duration of the plans and changes in the populations who purchase the plans.” That may be so, but for Golden Rule the MLRs have been coming down — the figures compiled by NAIC for UnitedHealth’s short-term plans fell from nearly 90% in 2011 to less than 40% in 2018.

“These policies are not right for everyone,” UnitedHealth says.

That’s true. But does every buyer know that? The lesson should be plain: These limited plans are useful only in very limited circumstances. Turning them into long-term substitutes for good health coverage only exposes their buyers to loss — and is a health hazard for everyone.

No comments